Panel 1

Fiorenzo Fumanti

The indicator quantifies fossil fuel mineral resource extraction activities (oil and gas) in Italy, providing data on site locations, production, reserves, and potential environmental impacts. As of 30 November 2024, there are 154 production concessions (55 offshore), 23 exploration permits (6 offshore), and 15 gas storage concessions, mostly concentrated in the Po Valley. Oil production, concentrated in Basilicata (91% of the national total), remains stable, while gas production is declining, with 3 billion Sm³ extracted in 2023. The suspension of exploration activities since 2019 and the introduction of the PiTESAI plan have reduced the number of concessions, thereby mitigating environmental impact. Italy's proven reserves amount to 41.8 billion Sm³ of gas (65.2% onshore) and 84.6 million tonnes of oil, mainly in Basilicata and Sicily.

The indicator considers extraction sites for energy resources (hydrocarbons). It defines the territorial distribution of production and exploration concessions and, consequently, their associated facilities (e.g., decantation basins and drilling waste landfills). It provides information on the volume of resources extracted, the available reserves, and indirectly, on the potential presence of pollution hotspots. These installations represent an important economic resource but also potential sources of land degradation. In addition to consuming non-renewable fossil resources, extraction activities may result in pollution, degraded air, soil, and surface/groundwater quality, subsidence phenomena, and landscape changes.

To quantify human activities related to energy resource extraction in terms of available resources and potential environmental and landscape impacts.

Hydrocarbon deposits are part of the State's inalienable assets. National legislation refers to Royal Decree No. 1443/1927, Laws No. 6/1957 and No. 613/1967 (onshore and offshore activities), Law 9/1991 (implementation of the 1988 National Energy Plan), Legislative Decree 625/1996 (EU licensing directive), Legislative Decree 164/2000 (gas market liberalization), Law 239/2004 (energy sector reorganization), and Law 99/2009 (energy and enterprise internationalization), which also establishes unified permitting procedures. Drilling, facility construction, and associated works are subject to environmental impact assessment (EIA). Legislative Decree 152/06 defines prohibited zones for offshore hydrocarbon activities. Following the Gulf of Mexico oil platform disaster, Legislative Decree No. 128/2010 introduced bans within environmentally protected coastal and marine areas, later extended nationwide by Legislative Decree No. 83/2012, Article 35.

The PiTESAI (Plan for the Sustainable Energy Transition of Suitable Areas) was approved by Ministerial Decree on 28 December 2021 (as per DL No. 135/2018, converted by Law No. 12/2019). The Plan identifies suitable areas for exploration, research, and production based on environmental, social, and economic criteria. Only applications for gas in potentially suitable areas submitted after 1 January 2010 may proceed. Existing concessions outside suitable areas will remain valid until expiry but cannot be renewed. Some PiTESAI provisions were simplified with DL 21 March 2022 in response to the Ukraine crisis. Ministerial directives from 28 June and 4 August 2022 and DLs 173/22 and 176/22 define procedures for long-term domestic gas procurement.

Panel 2

MASE-DiE-IS-UNMIG (2024) - Data Book 2024: 2023 Activities. MISE-DGISSEG-UNMIG (2020) - Il Mare. BUIG Special Issue, October 2020. MASE-DiE-IS-UNMIG (2024) - Official Hydrocarbon and Georesource Bulletin, November 2024.

Data Collection Frequency Annual

Data Source Ministry of the Environment and Energy Security (MASE)

Homogeneous information at the national scale on the environmental status of energy resource extraction sites is not available.

Improve information related to the environmental issues of energy resource extraction sites.

Data quality assessment

Ministry of the Environment and Energy Security (MASE)

The indicator provides a comprehensive overview of Italy's underground liquid and gaseous energy resources and their environmental pressures. Data are reliable, regularly updated, follow international standards, and are temporally and spatially comparable, including international benchmarking.

National, Regional

1982 - November 2024

Indicator assessment

Processing of UNMIG hydrocarbon data using spreadsheets and GIS applications.

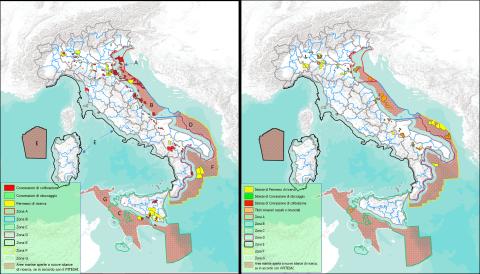

The indicator has the dual objective of quantifying the available geo-resources and assessing the potential environmental impact of extraction sites. As of November 2024, there are 154 active hydrocarbon exploitation concessions (55 offshore), 23 exploration permits (6 offshore) (Table 1), and 15 gas storage concessions (Table 2) in the national territory. Onshore, the greatest environmental pressures are recorded in Basilicata, where the largest area under concession and the highest hydrocarbon production are found. In offshore areas, the highest number of facilities is located in the central and northern Adriatic. The suspension of exploration activities from 2019 until the adoption of PiTESAI, and the subsequent expiration or renunciation of mining titles located in non-suitable areas, has certainly mitigated the environmental impact on land and at sea. However, a homogeneous overview of the environmental status of extraction sites is still lacking and will need to be assessed based on new policies concerning the exploitation of national resources.

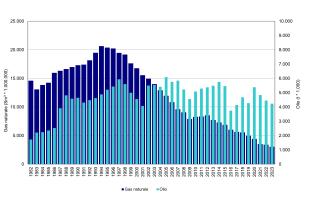

In 2023, the decades-long decline in gas extraction continued, along with a decrease in oil production (Figure 1). Mining titles also continued to decrease, partly due to the restrictions imposed by PiTESAI (Figures 2 and 3). However, the energy crisis resulting from the changed geopolitical situation is leading to a reconsideration of national resource exploitation and a likely revision of PiTESAI. An assessment of the trend will only be possible in the coming years.

Data

Table 1: Mining titles for the exploitation and exploration of hydrocarbons by region, province, and marine area, with related wells (as of 30/11/2024)

ISPRA processing based on data from the Ministry of Environment and Energy Security – Directorate General for Infrastructure and Safety (IS) – National Mining Office for Hydrocarbons and Georesources (UNMIG)

ZONE “A” – Northern and central Adriatic Sea;

ZONE “B” – Central and southern Adriatic Sea;

ZONE “C” – Southern Tyrrhenian Sea, Strait of Sicily, southern Ionian Sea;

ZONE “D” – Southern Adriatic Sea and Ionian Sea;

ZONE “E” – Ligurian Sea, Tyrrhenian Sea, Sardinian Sea;

ZONE “F” – Southern Adriatic Sea and Ionian Sea;

ZONE “G” – Southern Tyrrhenian Sea and Strait of Sicily

Table 2: Onshore natural gas storage concessions, with related wells, by region and province (as of 30/11/2024)

ISPRA processing based on data from the Ministry of Environment and Energy Security – Directorate General for Infrastructure and Safety (IS) – National Mining Office for Hydrocarbons and Georesources (UNMIG)

Table 3: Territorial impact of energy production activities (data as of 30/11/2024)

ISPRA processing based on data from the Ministry of Environment and Energy Security – Directorate General for Infrastructure and Safety (IS) – National Mining Office for Hydrocarbons and Georesources (UNMIG)

a Includes non-flowing productive wells, monitoring wells, non-productive wells, and others

b In the territory of Friuli Venezia Giulia there is a small part, without installations, of a concession from Veneto

c Titles that extend across multiple regions are counted more than once, once for each region

d The percentage is calculated over the entire national territory and therefore includes regions with no installations

Table 4: Production from extractive activities (31/12/2023)

ISPRA processing based on data from the Ministry of Environment and Energy Security – Directorate General for Infrastructure and Safety (IS) – National Mining Office for Hydrocarbons and Georesources (UNMIG)

Table 5: National hydrocarbon production by region/marine area (2023)

ISPRA processing based on data from the Ministry of Environment and Energy Security – Directorate General for Infrastructure and Safety (IS) – National Mining Office for Hydrocarbons and Georesources (UNMIG)

Table 6: Oil and gas resources and reserves (2023)

ISPRA processing based on data from the Ministry of Environment and Energy Security – Directorate General for Infrastructure and Safety (IS) – National Mining Office for Hydrocarbons and Georesources (UNMIG)

Figure 2: Map of active mining titles for hydrocarbon exploration, exploitation, and storage (Left); Map of new applications and expired titles (Right) (as of 30/11/2024)

ISPRA processing based on data from the Ministry of Environment and Energy Security – Directorate General for Infrastructure and Safety (IS) – National Mining Office for Hydrocarbons and Georesources (UNMIG)

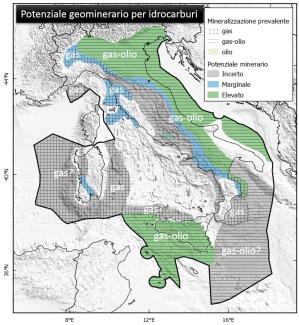

Figure 5: Perimeter of geomining potential defined by geological criteria for hydrocarbons (2022)

ISPRA processing based on PiTESAI, Sustainable Energy Transition Plan for Suitable Areas

-

High Mining Interest: Areas where exploration has been most successful and where concessions and permits have historically been concentrated

-

Marginal Mining Interest: Areas with sporadic mineral findings but not geologically unfavorable; significant deposits cannot be ruled out

-

Uncertain Mining Interest: Areas with little investigation but potentially favorable geological conditions based on limited data

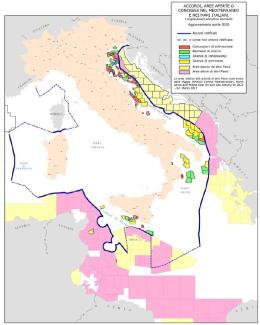

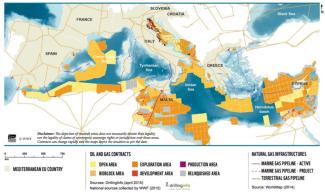

Figure 6: Distribution of Italian mining titles and areas open for exploration or granted for exploitation by neighboring countries (30/04/2020)

Ministry of Economic Development (2020). Il Mare, third edition. Special issue of the Official Bulletin of Hydrocarbons and Georesources (BUIG), October 2020

Figure 7: Mediterranean areas with hydrocarbon exploitation concessions, exploration permits, and areas open to exploration applications (2015), including pipeline routes

Marine Ecosystem Restoration in Changing European Seas (MERCES project). WP1, Deliverable 1.2: Current marine pressures and mechanisms driving changes in marine habitats

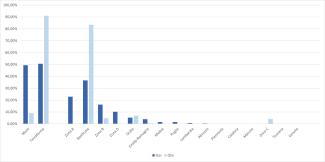

Figure 4: National hydrocarbon production by region/marine area (2023)

ISPRA processing based on data from the Ministry of Environment and Energy Security – Directorate General for Infrastructure and Safety (IS) – National Mining Office for Hydrocarbons and Georesources (UNMIG)

The concession for hydrocarbon exploitation is issued by MASE at the end of a long and complex procedure that begins with an application for an exploration permit. Currently, the request can only be submitted for the exploration of gas fields and only in areas deemed potentially suitable by PiTESAI. Initially, non-invasive surveys (prospecting) are carried out, and if potential hydrocarbon deposits are identified, authorization is requested to drill an exploratory well. If the well is successful, an application for concession is submitted. The granting of the mining title (permit/concession) is subject to the EIA (Environmental Impact Assessment) conducted by MASE, the opinion of the involved Entities, and the review by CIRM (Commission for Hydrocarbons and Mineral Resources). As of 11/30/2024, there are 154 active hydrocarbon exploitation concessions (55 offshore) and 23 exploration permits (6 offshore) (Table 1). 27 exploitation titles and 2 exploration permits have ceased and are awaiting the environmental restoration of the area. The cancellation of a mining title is, in fact, contingent upon environmental restoration, which takes place after the preparation of a remediation plan and ministerial evaluation in agreement with the competent region.

The onshore area covered by active titles amounts to 8,666 km², of which 4,517 km² are for exploration permits (Table 1), with a reduction of 1,340 km² compared to the previous year. The regions with the largest portions of territory covered by hydrocarbon mining titles are Emilia-Romagna (41), Sicily (18), Marche (16), Basilicata (12), and Lombardy (11), with a high concentration of exploitation concessions in the provinces of Bologna (14), Matera (10), Fermo (9), and Foggia (6). In the offshore subsurface, Zones A and B stand out for the high number of concessions (31 and 18 respectively) (Table 1).

The 15 active gas storage concessions, by reinjection into depleted reservoirs, remain unchanged and are concentrated in the Po Valley (6 in Lombardy and 5 in Emilia-Romagna) (Table 2). However, the surface area covered by titles does not reflect the real impact on the territory, since title areas are defined by current regulations as arcs of meridians and parallels of approximately 1°, and are therefore much larger than the areas actually occupied by the facilities. The actual land consumption due to exploitation activities in Italy is about 14.1 km², corresponding to 0.0047% of the national territory (Table 3). The highest land consumption occurs in Emilia-Romagna, amounting to 0.022% of the regional territory. Within the title area, zones not used by facilities remain freely accessible for other uses.

The assessments for 23 exploration permit applications are underway, including 11 offshore, and 5 exploitation concession applications, of which 1 is offshore (Figure 2). The amount of material extracted in 2023 shows a decrease in oil production, which stands at 4.23 million tons, accompanied by the ongoing historical decline in gas production, now down to just over 3 billion Sm³ (Table 4, Figure 1).

Oil production is concentrated onshore (91% of the national total), thanks to fields in Basilicata and, to a much lesser extent, in Sicily. Since 2023, onshore gas production has surpassed offshore production (50.6% vs. 49.4%). Most gas is now produced from onshore wells (50.6% of the national total) due to the production decline in Zone A (from 26.6% to 22.9% of the national total). Onshore, significant gas production is found only in Basilicata, which accounts for 36.6% of the national total (Table 5, Figure 4).

As of 11/30/2024, there are 825 productive wells onshore, of which 399 are delivering oil (71) or gas (328), with a higher concentration in Emilia-Romagna (187 gas and 6 oil) and in Sicily (41 gas and 31 oil), and at the provincial level in Bologna (125 gas wells), Florence (42 gas), Modena (25 gas, 6 oil), and Caltanissetta (28 oil). The other 426 productive wells were not producing at the time of the survey. Offshore, out of 700 productive wells, 195 are producing, mostly extracting natural gas (138), particularly in Zone A (8) (Table 1).

Italian hydrocarbon reserves are calculated according to internationally defined criteria and are divided into proven, possible, and probable categories. In 2023 (Table 6), proven gas reserves stood at 41,807 million standard cubic meters, 65.2% of which are located onshore. Proven recoverable oil reserves are estimated at 84,630,000 tons concentrated onshore (94.2%), especially in Southern Italy and mostly in Basilicata. This distribution, showing greater oil reserves than gas, is reflected in the historical trend of extraction (Table 4, Figure 1). Gas production reached its historic peak in 1994, when it covered 40% of national demand, followed by a progressive decline. Conversely, oil production has remained between 4 and 6 Gt annually over the past 35 years.

The trend in natural gas production indicates a progressive depletion or partial exploitation of old fields not offset by new discoveries entering production, also due to a lack of investment in exploration. The development of the two most promising discovered gas fields is currently blocked for different reasons. The first (North Adriatic) due to the hazardous impacts on the Venice area, while the second (Argo-Cassiopea-Panda offshore of Gela) is still suspended.

From a reservoir geology perspective, the most important petroleum provinces are the Upper Adriatic and Po Valley (gas and oil), the Pescara Basin (oil and gas), the Southern Adriatic (oil and gas), the Southern Apennines (oil), the Bradanic Trough in Apulia (gas and oil), the Calabrian offshore (gas), Central Sicily (gas), and the Pelagian Islands Basin (oil) (Figure 5). However, there are still large areas where exploration activities have been limited or absent due to logistical and/or economic reasons or, in the case of border waters, international politics. The Italian parts of the deep Southern Adriatic and Ionian basins remain largely unexplored, although neighboring countries (Croatia, Montenegro, Albania, Greece) are investing heavily. A similar situation is seen in the Sicily Channel, where some companies are exploring seabeds adjacent to Italian waters, with significant discoveries. The Provençal Basin west of Sardinia is practically unexplored.

The situation differs in the Tyrrhenian Sea, whose geological features offer little prospect of discoveries. Environmental issues related to extraction processes should therefore be framed and evaluated also within the geopolitical context of the Mediterranean, considering that coastal countries, whether neighboring Italy or not, have opened almost all of their seabeds to exploration and exploitation, and that potential incidents could also impact marine areas under Italian jurisdiction (Figures 6 and 7). There is no updated cartography of the Mediterranean area, but Figures 6 and 7 still provide an indication of the major ongoing interests at the continental scale and the potential risks for our seas.