Panel 1

Cristina Frizza

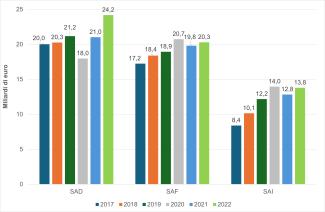

In 2022, the sixth edition of the Catalogue of Environmentally Relevant Subsidies identified a total of 183 measures, resulting in €24.2 billion in Environmentally Harmful Subsidies (EHS) and €20.2 billion in Environmentally Beneficial Subsidies (EBS), representing a year-on-year increase of 15.1% and a decrease of 2.5%, respectively. Subsidies amounting to €13.8 billion were classified as having uncertain environmental impact, marking a 7.5% increase compared to 2021. Among the Environmentally Harmful Subsidies, those related to fossil fuels accounted for €17 billion in 2022 (compared to €13 billion in 2020 and €14.8 billion in 2021).

The indicator identifies subsidies with environmentally beneficial, harmful, or uncertain effects. Subsidies include incentives, concessions, soft loans, and tax exemptions explicitly aimed at environmental protection. Subsidies are classified into two main categories: direct subsidies (such as direct transfers of funds and grants) and indirect subsidies (including tax expenditures, incentives, and exemptions). Indirect subsidies also include implicit subsidies, which may arise from the general tax system and create incentives that influence production or consumption behaviours in ways that can be either environmentally beneficial or environmentally harmful. The indicator provides information on both direct and indirect incentives related to energy resources, with the objective of supporting environmental fiscal reform aimed at decarbonising the economy and promoting environmentally beneficial activities.

Summarising subsidies with environmentally beneficial and harmful effects aims to provide policymakers with the necessary information to support the phase-out of environmentally harmful subsidies (EHS) and the adoption, strengthening, and improvement of environmentally beneficial subsidies (EBS).

Article 68 of Law No. 221 of 28 December 2015 established, within the Ministry of the Environment and the Protection of Land and Sea, the Catalogue of Environmentally Harmful Subsidies (EHS) and Environmentally Beneficial Subsidies (EBS). The Catalogue is managed using the existing human, financial, and instrumental resources available under current legislation, without generating new or additional burdens on public finances.

The same article mandates that the Catalogue be updated annually by 30 June.

The main objectives of the Catalogue are as follows:

a) to identify policy measures aimed at fiscal reform in line with the "polluter pays principle";

b) to reduce the tax burden on labour and businesses, while offsetting revenue losses through environmental taxation targeting environmentally harmful consumption and production;

c) to reduce overall tax expenditures.

Panel 2

MASE, Catalogo dei sussidi ambientalmente dannosi e dei sussidi ambientalmente favorevoli ed. 2024

Data quality assessment

MASE- Ministry of the Environment and Energy Security

MASE - Catalogue of Environmentally Harmful Subsidies (EHS) and Environmentally Beneficial Subsidies (EBS) - https://www.mase.gov.it/portale/catalogo-dei-sussidi-ambientalmente-dannosi-e-dei-sussidi-ambientalmente-favorevoli

National

2017-2022

Indicator assessment

The definition of subsidy adopted in the Catalogue aligns with that used by the OECD, and includes—among other instruments—“incentives, concessions, soft loans, and tax exemptions explicitly aimed at environmental protection.” This definition encompasses both tax expenditures and direct subsidies.

In identifying the various subsidies, multiple methodologies are considered (e.g. quick scan, checklists, etc.), with the aim of providing policymakers with the necessary information to support the phase-out of Environmentally Harmful Subsidies (EHS) and the adoption, strengthening, and increased efficiency of Environmentally Beneficial Subsidies (EBS).

Similarly, different approaches are taken into account for the quantification of subsidies, such as the price gap method, marginal social cost estimates, and assessments of external costs.

In 2022, the value of Environmentally Harmful Subsidies (EHS) amounted to €24.2 billion, while Environmentally Beneficial Subsidies (EBS) totalled €20.3 billion. Subsidies with an uncertain environmental impact reached €13.8 billion. Given the high share of subsidies classified as environmentally harmful (41.5% of the total), the overall balance can be considered environmentally negative.

In 2022, all categories of environmentally relevant subsidies showed an increase compared to 2017. Environmentally Harmful Subsidies (EHS) rose by 20.9%, exceeding the growth rate of Environmentally Beneficial Subsidies (EBS), which increased by 17.7%.

Subsidies with an uncertain environmental impact grew by more than 64%, outlining a slightly deteriorating trend in the overall environmental quality of public support measures.

Data

Table 1: Estimated total annual subsidies by sector and type (million euros)

MASE: Ministry of the Environment and Energy Security

SAD: Environmentally Harmful Subsidy; SAF: Environmentally Beneficial Subsidy; SAI: Environmentally uncertain subsidies

In 2022, Environmentally Harmful Subsidies (EHS) increased by 15.1% compared to the previous year, while Environmentally Beneficial Subsidies (EBS) grew by 2.5% (see Figure 1 and Table 1). Subsidies with uncertain environmental impact rose by 7.5%.

Subsidies are distributed across the categories ‘Agriculture and Fisheries’, ‘Energy’, ‘Transport’, ‘Other Subsidies’, and ‘Reduced VAT’, based on international classifications and the relative environmental impact of each sector. In 2022, the ‘Energy’ and ‘Reduced VAT’ categories accounted for over 64% of Environmentally Harmful Subsidies; the ‘Energy’ and ‘Agriculture and Fisheries’ categories represented more than 57% of Environmentally Beneficial Subsidies; and the ‘Reduced VAT’ and ‘Agriculture and Fisheries’ categories covered over 73% of subsidies with uncertain attribution (see Table 1).

Category-specific analysis also shows a year-on-year increase in Environmentally Harmful Subsidies in ‘Other Subsidies’ (+59.3%) and ‘Reduced VAT’ (+25%), while decreases were observed in ‘Energy’ (-13.4%), ‘Agriculture and Fisheries’ (-2.4%), and ‘Transport’ (-3.7%) (see Table 1).